In the electric industry, baseload refers to the minimum level demand over 24 hours. The baseload is generally about 30 – 40 % of the peak load. Traditionally the baseload has been served by low cost power generators, operating steadily and continuously.

Coal fired power plants, nuclear, and (depending on geography) hydro have been the backbone of baseload generation. Operating in “baseload mode” is more or less a prerequisite for nuclear and coal-fired power plants. That is because of their high fixed costs and need to run due to long start-up times and limited ability for load-following.

This paradigm has started to change. Here in the US, the shale gas revolution in combination with continued technology improvement have made natural gas fired combined cycle gas turbines (CCGT) the lowest cost generation. Analyzing future costs of new generation, the Energy Information Agency (EIA) concludes natural gas fired CCGTs will continue to be the lowest cost generation also in 2022. Increasingly variable resources like wind and solar are becoming low cost generation, with the tax credits close to the cost of the CCGTs. Already without subsidies the cost for wind and solar has come down dramatically during the last decade. The fuel is free, making the marginal costs very low. In cases of feed-in tariffs or production tax credits the wind and solar resources may at times bid in to the electricity markets at negative prices.

The new paradigm, variable resources of wind and solar as a major part of the baseload generation, comes with a new set of opportunities and challenges. The main opportunities are positive environmental benefits in terms of improved air quality and reduced greenhouse gases (GHG) and potentially lower energy costs. The main challenge is how to balance the variable resources at a reasonable cost without compromising reliability.

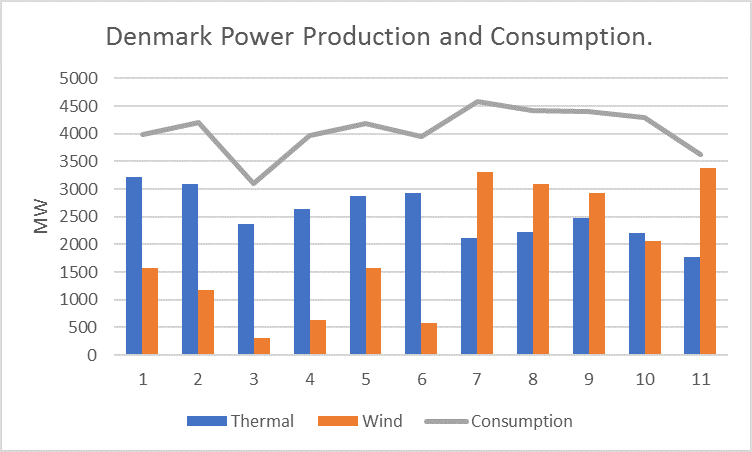

The variations of wind and solar can be significant. It can be illustrated by Denmark, considered to be a worldwide leader in wind generation. In fact, on February 23 this year Denmark generated enough wind power to cover all the country’s demand for electricity. On the average wind generation covers 40 – 50 % of the load. However, the wind can fluctuate substantially. To balance the fluctuations Denmark depends on thermal power (coal and natural gas) and the ability to export excess and import at times of shortage, especially from Sweden (nuclear and hydro) and Norway (hydro). Denmark has very strong electric ties with neighboring countries, about 6000 MW, which most of the time exceeds the consumption of power. Taking a random sample during eleven consecutive days in March shows wind could be as high as 93 % of the load and as low as 10 %. The thermal power, which makes up the difference, had to run at more stable levels, about 51 – 80 % of the load. When the total production was higher than the consumption the surplus was exported. During the 11 days’ sample Denmark exported power 7 days with as much as 42 %. During the same period, Denmark imported 4 days with as much as 17 %.

Random sample of 11 consecutive days in March 2017.

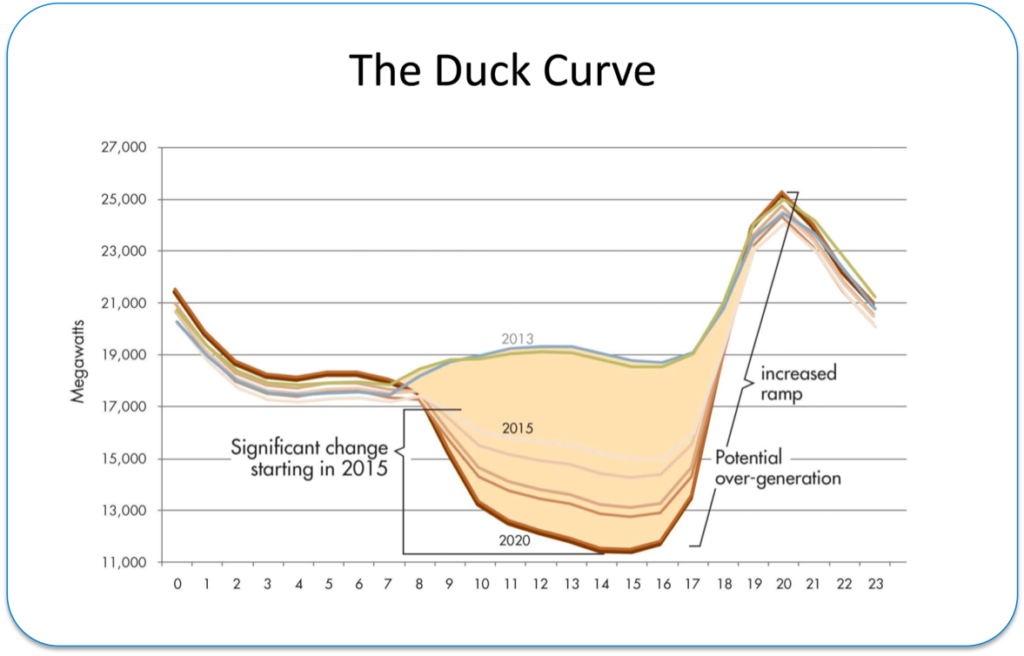

The fluctuations from solar are different from wind. With solar it is more about the fluctuations between day and night than between days. The balancing challenge comes in the late afternoon, when the load tends to go up at the same time the power from the solar goes down. California and Hawaii with large amounts of solar on the system are experiencing the “duck curve”, which shows the need for fast ramping resources. Even so, the high amounts of solar have forced the California Independent System Operator (CAISO) to curtail wind and solar, probably with 6000 – 8000 MW this spring. As renewable resources continue to grow CAISO expects curtailments to become more frequent and may reach 13000 MW in 2024. The fast ramping resources have been natural gas and hydro. The loss of Aliso Canyon gas storage in 2015 has triggered several initiatives to substantially expand energy storage.

California’s duck curve as illustrated by Greentech Media. The duck curve shows the power generation excluding the solar generation. CAISO coined the graph as the “duck curve”.

As the cases of Denmark and California show: When wind and solar is becoming a big part of the base load, the two main ways to balance these variable resources are flexible power generation and robust transmission system with strong ties with neighboring systems. Energy storage and flexible load are additional “tools” to balance the variations.

Flexible load can be achieved several ways such as demand response, time-of-day rates. Some see transactive energy, i.e retail level markets with distributed energy resources (DER) (generation and storage) and a multitude of smart devices, as the future model to best match variable resources and flexible loads.

In terms of flexible generation, natural gas and hydro are superior. Impressive efforts have been made to make coal and nuclear more flexible, but still they cannot respond and ramp as fast as natural gas and hydro. Further, when nuclear and coal do not operate as base-load the economics start to deteriorate. Natural gas plants have the additional advantage of being economical also at lower capacity factors as well as with smaller units. An interesting case is Denton Municipal Electric, north of Dallas, Texas. With Wärtsilä as the supplier they are building a 225 MW “ultra-flexible Smart Power Generation Plant”. The plant will have 12 natural gas fired reciprocating engines, each rated 18.8 MW, and will go in operation this year. The purpose of the plant is to economically enable the share of renewable energy to go from 40 % to 70 % by 2019.

In any case one needs extra installed capacity to balance wind and solar. It has raised the question who and how to pay for the capacity needed. PJM and New England have capacity markets designed to pay for performance, while Texas is an uncapped energy market only, not directly paying for capacity. Remarkably, Germany, with their Energiewende, the aggressive push for wind and solar, pays only for a minimum reserve capacity. The large German utilities, who own most the coal fired power plants, have not been compensated for keeping these resources, but they have managed to offset some of the costs of the plants by substantially increasing the export of power to neighboring countries. Contrary to the US, the high natural gas prices in Europe makes it more difficult for CCGTs to compete with the lignite coal. However, more generation from the coal plants, does not help in the efforts to reduce GHG!

In terms of transmission the larger and the more robust transmission system the easier it is to integrate and balance large amounts of variable resources, wind and solar. California illustrates this well. With the targets of reaching 50 % of renewables (excluding large hydro, >30 MW) with the largest portions expected from wind and solar by 2030, has taken several initiatives to strengthen the transmission system with neighboring states as well as developing a Western grid balancing market.

The downside with an ever increasing and tighter integrated transmission system is that the consequences will be more severe in the rare case of a major event (e g natural disasters, cyber and/or physical attacks). The risks can be mitigated by sectionalizing the system like South China and/or more use of bilateral HVDC links like in northern Europe as well as deploying microgrids.

When there is no or limited transmission to neighboring systems energy, storage becomes important. For large amounts of energy storage hydro with dams and pumped hydro is generally the most economical energy storage. Lithium ion batteries started in 2008 to be applied as resources for fast response frequency control. With performance improving and costs coming down, lithium ion batteries are now also being deployed for diurnal energy storage, for example 3-6 hours’ storage from the time of the daily peak generation to the time of the daily peak load.

Kauai Island Utility Cooperative (KIUC) is one of the world leaders in terms of solar on their system. Kauai is an island and has no neighboring transmission systems. They have been early in using lithium batteries for frequency control and are now becoming a leader in dispatchable solar, i.e solar generation combined with large batteries. This combination makes it possible to dispatch the power in the same way as a traditional power generator. The first system delivered by Tesla/Solar City recently went live. It consists of 17 MW of photovoltaic (PV) and 52 MWh of battery storage. KIUC signed a 20-year power purchase agreement (PPA) at 13.9 cents/kWh. In January Kauai Electric announced a second system. This system delivered by AES Distributed Energy will consists of 28 MW of PV and 100 MWh of battery storage. The 20 year PPA is at 11 cents/kWh. When it will be energized in late 2018, it is expected to help Kauai achieve its goal of 50 % renewable energy, primarily solar, on their system.

AES/Dayton Power & Light 40 MW lithium ion battery at Tait, Ohio. AES pioneered large lithium ion battery systems for the ancillary services markets and has become the global market leader in grid-scale battery storage.

In summary: Increasingly wind and solar together with natural gas are becoming the new base load generation. The variable resources can be managed with flexible generation, expanded and strengthened transmission systems, energy storage and flexible load. The challenge is to do it in an optimal way measured, as Energy Innovation recommends, in affordability, reliability/resiliency and environmental impact.