In May 584 000 cars and 935 000 light duty vehicles were sold in the United States. Only 1.1 %, or 16,788 to be precise, of these vehicles were electric (EV) or plug-in electric (PEV)s. Not a big number, but in terms of battery storage the numbers get more significant.

For the month of May, the total amount of battery storage in the EVs and PEVs cars is 570 MWh. In comparison, according to GTM Research/ESA US Energy Storage Monitor, for all the first quarter this year 234 MWh of stationary “utility scale” electric storage was added and another 13 MWh of distributed storage was installed behind the electric meter.

Tesla with Model S and Model X stood for about 285 MWh, 50 % of the total battery capacity of the EVs and PEVs in May. In comparison Sonnen, the most successful company in distributed battery storage, with an installed base of over 10 000 systems (2016) in the aggregate has delivered about 100 MWh (assuming in average 10 kWh per system).

On an annual basis, the energy storage of the cars would add up to a capacity of 6.8 GWh. It is a big number. Nevertheless, it is dwarfed by pumped hydro storage, which is by far the dominant resource for bulk electric storage, at an estimated installed base of 220 GWh (22 GW of power for about 10 hours). If the sales of EV and PEVs would increase to 10 % of all cars and light duty vehicles it would be close to 70 GWh per year. At that pace 3years of accumulated EV/PEV sales would equal the total amount of pumped hydro storage.

The EVs and PEVs will need to be charged. It is a load growth, but at present numbers it is not really a challenge for the electric grid, except some local constraints in the distribution system. If and when EVs and PEVs would grow to 10 % of all vehicles sold, it will start to be noticeable, but still should not be a major challenge.

EV/PEV batteries will also be an opportunity for the grid. With more variable resources, wind and solar on the grid, the importance of the opportunity is increasing. There are four main ways it may take. The ways are not mutually exclusive:

- Grid to vehicle, V1G.

- Vehicle to grid, V2G.

- Smart home.

- Secondary use of the car batteries

One V2G application is to have an aggregated fleet of cars to participate in ancillary service markets for frequency regulation. It has been demonstrated, for example 2013 in a pilot project in PJM with a fleet of 15 BMW Minis. Technically it works and can be economically attractive. However, indications are that V2G will not become significant. One reason is that the ancillary service markets are relatively small markets and will be saturated, driving prices and making it economically less attractive. Another reason is that the automotive companies seem not very excited that their batteries may be cycled fast and in a different way than what the batteries have been designed for. They are concerned about the battery life and potential implications on the battery warranties.

For V1G one example how “smart charging” can be done was shown in a pilot program by PG&E and BMW, iCharge Forward. From July 2015 to December 2016 100 BMW i3 drivers in the San Francisco Bay Area participated. 209 demand response (DR) events were dispatched during the 18 months. Customer acceptance was high, 93 % of the customers said they are likely to participate in similar programs in the future. BMW had already 2014 launched an app to make it possible for the BMW I customers to automatically identify the best rates and times for charging their electric vehicles at home.

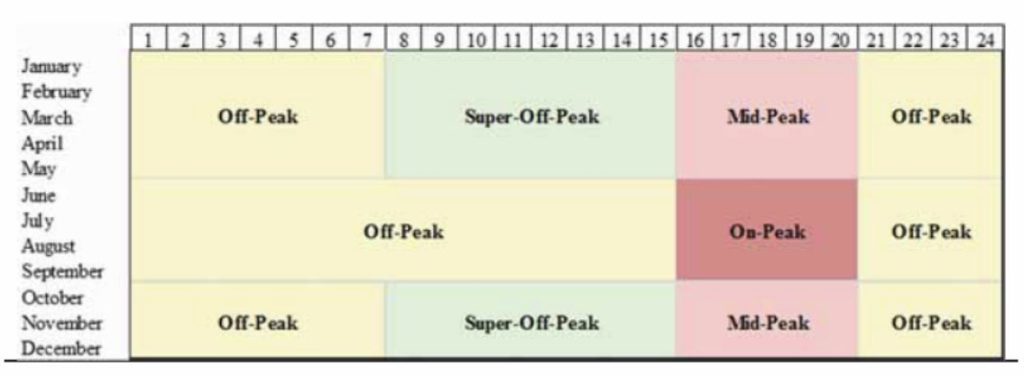

It gets more complicated to find the win-wins for workplace charging and public charging, especially public DCFC (direct current fast chargers). The consumer looks for convenience and cost, while the utility looks for revenue and/or cost recovery. In a study presented earlier this year, EVgo Fleet and Tariff Analysis by RMI/Chris Nelder and Garrett Fitzgerald studied every charging session in 2016 from all 230 EVgo’s DCFC stations in California. They found that present rate structures could result in very high electricity costs due to high demand charges. Looking forward the report analyzes different rate designs and suggests more optimal tariffs based on time of use (ToU), such as a new proposed ToU schedule by Southern California Edison (SCE), taking advantage of large amounts of solar power at midday, especially during the winter months, but demanding a high price at the peak in the late afternoon, when the steep ramp-up of the “duck curve” hits.

Proposed TOU Weekday Periods for New V Rates. Source: RMI report EVgo Fleet and Tariff Analysis. Southern California Edison.

The smart home concept in its basic version has the option to use the car battery as an emergency power back-up. Since the average household consumes about 30 kWh per day an EV car battery could supply a home for a day and more. In more advanced versions of the smart home the car battery may help balance fluctuations in a home. If the home has rooftop solar the battery may be programmed to optimize charging at day time. The house may also include a stationary battery, which in combination with the car battery could help minimize the demand charge, etc. The first version of a smart home was demonstrated by Nissan. Going forward, it seems likely that Tesla, being the one-stop shop of electric cars with large car batteries, photovoltaic (PV) and stationary batteries, will take the lead in advancing the smart home concept.

The secondary use of car batteries, a concept launched by GM, is the joker in the deck of possible impact of car batteries on the grid. Technically, it has been demonstrated in several pilot projects, for example by Toyota and BMW. At a first glance, it sounds like a great concept to repackage car batteries after their “vehicular life” of 8-10 years to be used in stationary applications. If the cost gets very low it may enable homes with PV to go off-grid. However, there are challenges. The repackaging of the battery is not free of charge. What is the performance and life of a battery of 8-10 years in a car? Would they perform or last for another 10 years? Even if the answers would be satisfactory, the cost of a new battery 8-10 years from now may come down so much, that by then it will be economically more attractive to buy a new stationary battery rather than an 8-10-year-old and used car battery!

In summary, EVs and PEVs already bring more battery storage capacity than stationary battery storage. The electric vehicles offer more opportunities than challenges for the grid. Most likely the best opportunity is to be a storage resource to help balance the variability of wind and solar. For a win-win “smart charging” using ToU rate designs reflecting the changing characteristics of the grid will be key. Eventually, but not to be underestimated, will be the indirect effects on the grid by reduced costs for stationary batteries thanks to economy of scale and technical progress of the car batteries.

Additional reading:

RMI. Electric Vehicles as Distributed Energy Resources. (2016) https://rmi.org/insights/reports/electric-vehicles-distributed-energy-resources/

RMI. EVgo Fleet and Tariff Analysis. (2017) https://rmi.org/about/news-and-press/press-release-rmi-evgo-report-reveals-utility-rate-structures-support-fast-charging-growth/