On February 24 Russia started an unprovoked full-scale invasion of Ukraine. It has resulted in colossal damage and sufferings. How the war will end nobody knows, but it seems clear that Ukraine will remain a free, independent, and democratic nation, while Russia will achieve truly little, if anything of its goals.

The war in Ukraine will also have unintended and significant energy and environmental consequences in all Europe. For some countries there will be changes in the direction of their respective energy structures and plans. In other cases, the direction will remain unchanged, but the speed of change will accelerate.

The most immediate change happened when Ukraine synchronized its electric grid with the ENTSO-E grid (European Network of Transmission System Operators for Electricity) on March 16. By all means and measures it was a huge engineering accomplishment. The first discussion had started in 2017. The target for completion was originally set for 2026, later adjusted to early 2023.

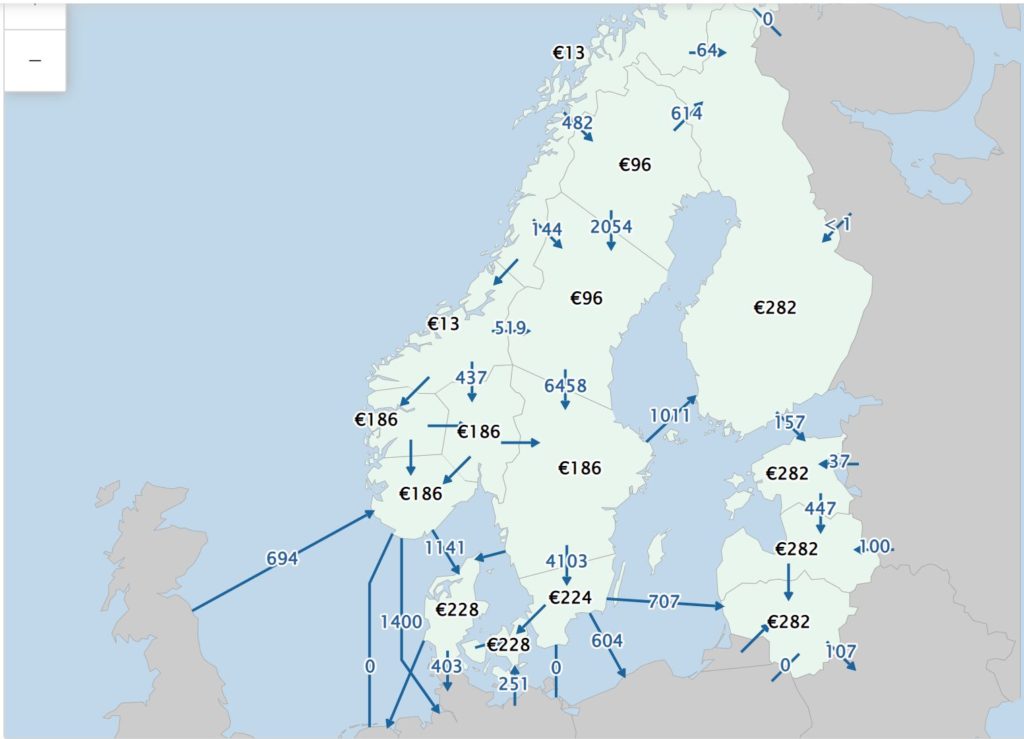

Cutting the electric ties with Russia so quickly was enabled by Ukraine having adequate domestic power generation. For the three Baltic States, Estonia, Latvia, and Lithuania it will be more challenging to desynchronize from the Belarus-Russia grid, since they are net importers of power. The solution here will be to building more transmission ties with Sweden, Finland, and Poland. The technology of choice and necessity is HVDC. There are already HVDC connections between Finland and Estonia, Estlink 1 and 2 with the combined capacity 0f 1000 MW. The NordBalt 700 MW HVDC link between Sweden and Lithuania has been in operation since 2015. When Harmony Link, the 700 MW HVDC link between Lithuania and Poland will be completed in 2025, it will be possible to cut all electric ties with Belarus and Russia.

The importance of strong ties with neighboring countries and the significance of HVDC for bilateral connections with submarine cables was very recently well illustrated when Russia announced suspension of electricity sales to Finland, which can be as much as 1300MW. Thanks to the strong AC and DC ties with Sweden, including the 1300 MW Fenno-Skan HVDC links, Finland easily offset the electric imports from Russia.

For the electric power generation, the consequences of the Russian invasion of Ukraine will be even bigger. Reactions from the European countries came fast and strong: Europe to be fully independent from Russian oil and gas by 2030, and already by the end of 2022 to have reduced the imports by two-thirds. Germany, who is the biggest importer of natural gas, takes about 55% of its gas from Russia. Seeing the writing on the wall, in February 22 this year, two days before Russia’s invasion, Germany put Nord Stream 2 on hold. This underwater pipeline would have doubled the export of natural gas to Germany from 55 billion cubic meters (bcm) to 110 bcm.

As part of the German Energiewende, the energy transition, in addition to the growth of wind and solar increasing the use of natural gas was a key component in the plans to replace the power from the remaining nuclear plants scheduled to be closed by the end of this year, and to phase out the coal plants, scheduled to be completed by 2037.

To compensate for the reductions in natural gas from Russia, Germany will have to increases in import of liquified natural gas (LNG), not least from the United States, but to replace all imported gas will require more LNG terminals to be built. There is also an opposition against natural gas produced by fracking to overcome. In the short-term we may also see the coal plants run more and for a longer time. Continue to operate the nuclear plants beyond 2022 could also be an option, but it is unlikely Germany will change its course on exiting nuclear power. The public and political opposition against nuclear remains strong. One can expect an intense debate between “pragmatists”, who prefer a longer use of conventional resources and more use of natural gas, at least as a transitional energy source, and “green purists”, who want to see an accelerated path towards 100% of Germany’s electricity to be generated from renewables.

In any case, Germany will continue to expand wind and solar generation. The Economy Ministry has proposed new legislation to increase onshore wind capacity annually by 10 GW by 2027, and solar to 20 GW annually by 2028. Corresponding numbers are now about 3 GW and 7 GW respectively. The target is to reach 200 GW installed capacity of solar, mostly rooftop solar, 100 GW of onshore wind and 30 GW of offshore wind by 2035. These are immense numbers, considering the present peak power demand in Germany is presently about 85 GW and average demand is around 55 GW. Given the plans to decarbonize/electrify the transportation, the industrial and the building sectors, the electric demand is expected to grow substantially, up to 200 GW by 2045. Even so, the planned growth of installed generation capacity will far exceed the expected demand.

If the targets are achieved, Germany will have 78% renewable energy, mostly from wind and solar, by 2035. Operating a system with such a high percentage of variable renewable sources is not a trivial matter. Several scenarios how the future German electric energy system will look like have been made by analysts and researchers. The conclusion is that for most of the time it will work well, assuming access to large amounts of flexible generation resources, battery storage and import of electric power from neighboring countries. At times of severe shortage massive quantities of imports will be needed. It will require substantial strengthening of the transmission ties.

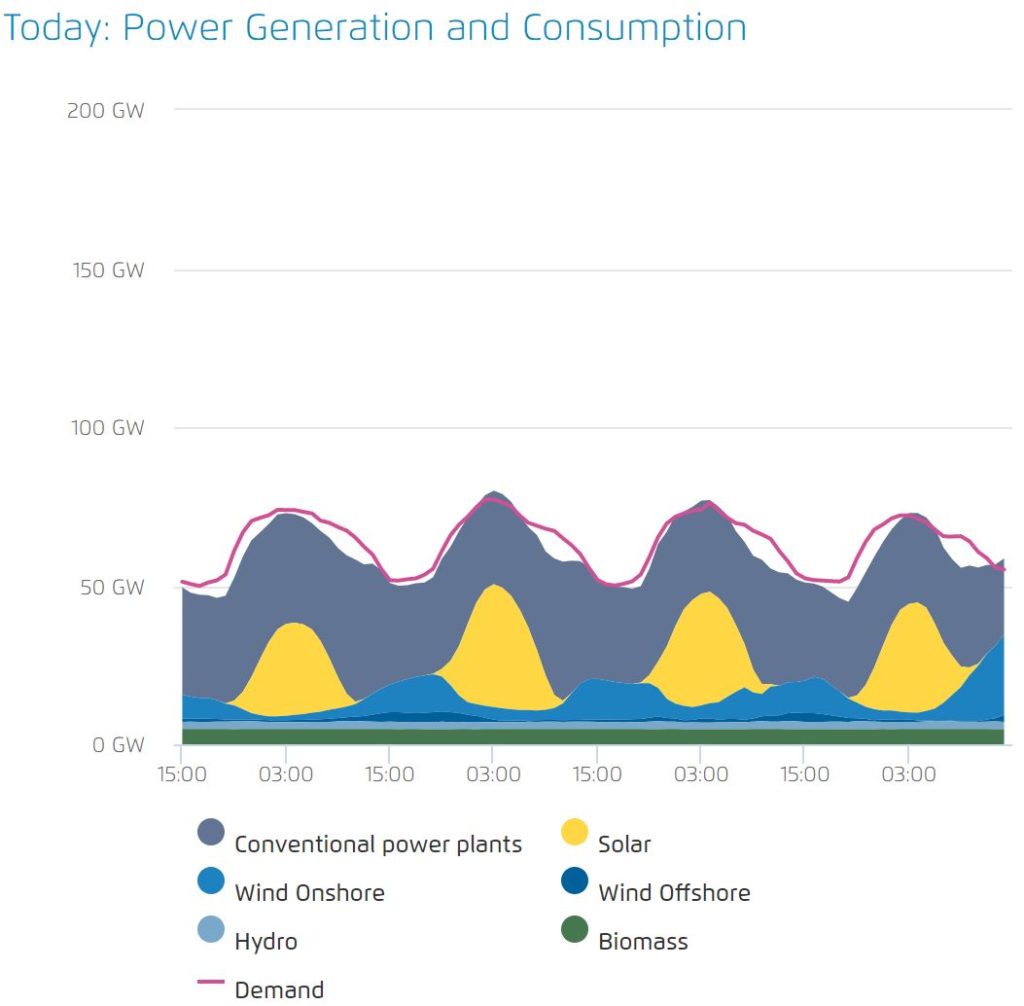

Agora Energiewende has developed a tool, “Future Agorameter”, to calculate probable future power generation and consumption situations. Using this tool one can compare future scenarios with actual conditions, using same weather data. As an example, the week of May 17-20 (2022) had generation and demand as shown below. Periods of excess and shortage were managed by export and import, respectively.

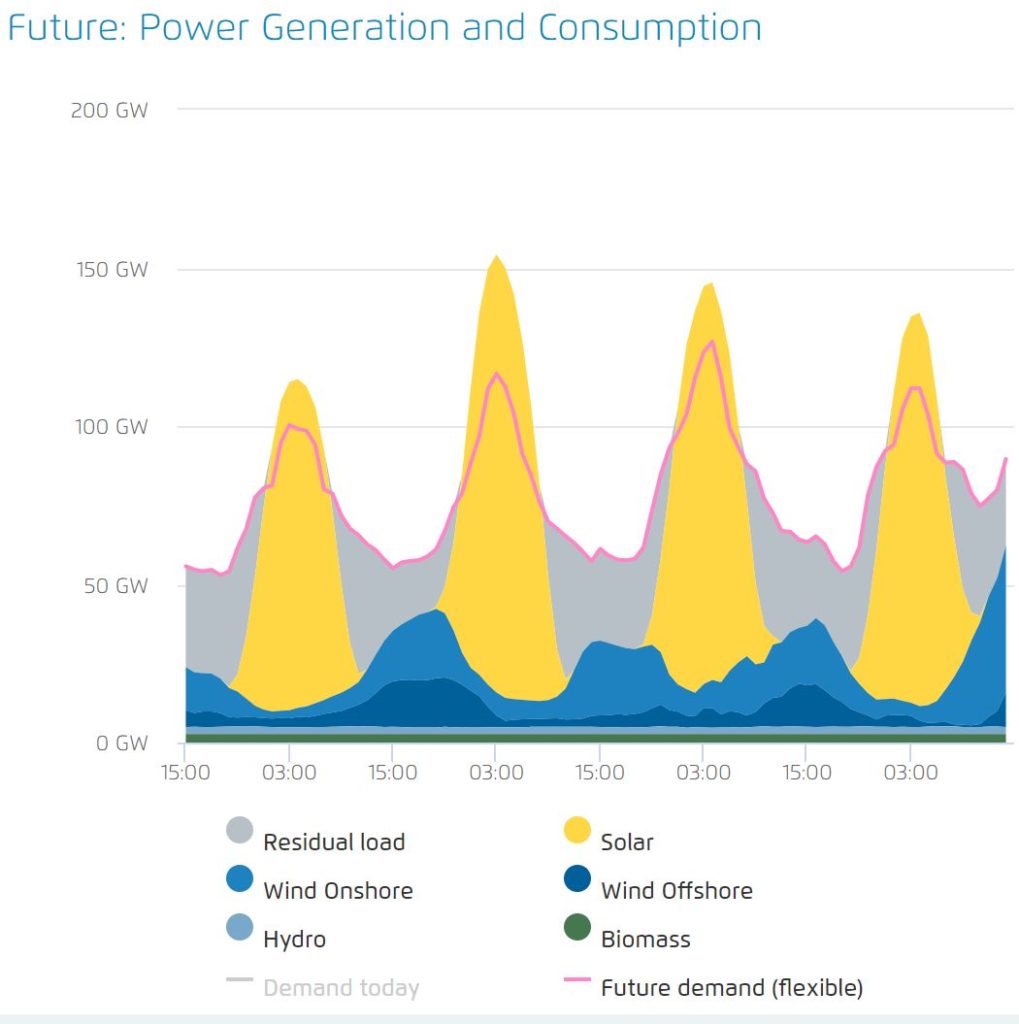

This picture will change dramatically going forward. A possible situation, based on targeted expansion of wind and solar for 2035 is shown below. Residual load refers to load to be served by imports, battery storage and conventional power generation. The total demand, as well as the amplitude between peak and valleys in generation and demand, will be much higher than in 2022.

In the future German electric system, there will also be periods of vast amounts of excess power. To avoid curtailing generation during those periods, some of the excess power may be exported to neighboring countries and/or stored in batteries, but it will be far from enough to avoid curtailing. For proponents of green hydrogen, it represents an opportunity cost to produce green hydrogen. Thirty percent of the electric energy is lost in the electrolysis, compression, and transportation of the hydrogen. It makes it much less efficient and less economical than using the electricity directly or stored in batteries, but the equation changes when the electric power is “free”.

Recognizing the possibilities of hydrogen of bulk energy storage, and as a potential fuel source for flexible generation, as well as the need for green hydrogen to enable production of “green steel”, Germany developed early a National Hydrogen Strategy. As part of the strategy, it also seeks to make Germany becoming a leader and exporter of green hydrogen technologies. $8.1 billion has been allocated to speed up the commercialization of hydrogen technologies, and to achieve 5 GW electrolyzers capacity by 2030. This target is now expected to be raised to 10 GW. Some studies suggest over 80 GW by 2045 as part of the Energiewende.

The energy transition is not a done deal, far from it. As with most long-term plans and forecasts there are many challenges and uncertainties, ahead. Assumptions of legislative and financial support can change. Can all the wind and solar be built? Can all needed new transmission lines be built? Will neighboring countries have enough power to export to Germany? Will decarbonization of the transportation sector move forward as projected or will supply chain issues for batteries slow the growth. If that happens, will hydrogen be more interesting to store energy and power vehicles? Will there be new battery technologies? Will progress of carbon capture utilization and storage (CCUS) will make natural gas more attractive and utilized? Will small modular reactors bring a renaissance for nuclear power? Etc.

Germany is not unique in targeting net zero emissions by 2045. Many other countries have the same goal by 2045 or 2050, but are accepting large hydro, new nuclear and/or natural gas with CCUS as part of the portfolio of technologies to get them there at a lower cost, and maybe faster. What makes Germany unique is their approach to achieve the net-zero goal with such a high portion, close to 90% of variable renewable sources, wind and solar.

Triggered by the Russian invasion of Ukraine, Germany will accelerate its already aggressive energy transition. The massive expansion of wind and solar may also get green hydrogen to take off. If so, who would have guessed such unintended consequences of the invasion? Certainly not Russia.