“When you come to a fork in the road, take it!” was Yogi Berra’s way to give directions to his house. In his case he was right, since both roads led to his house. In the case of the German Energiewende it is not as clear what road to take and some roads may not even lead to the destination.

The German Energiewende is the very ambitious plan set in 2000 to transition to 80 % renewables by 2050. The plan was revised 2011 after the Fukushima incident to also include a complete phase out of nuclear by 2022. On the route to 2050 renewable energy is targeted to reach 35 – 40 % by 2025 and 55-60 % by 2035. Wind and solar is expected to represent 70 % of the renewables by 2020 and 80-90 % by 2050. Energy efficiency is also a key component of the Energiewende with the aggressive targets to reduce the consumption of energy by 10 % from 2008 to 2020 and by 25 % by 2050.

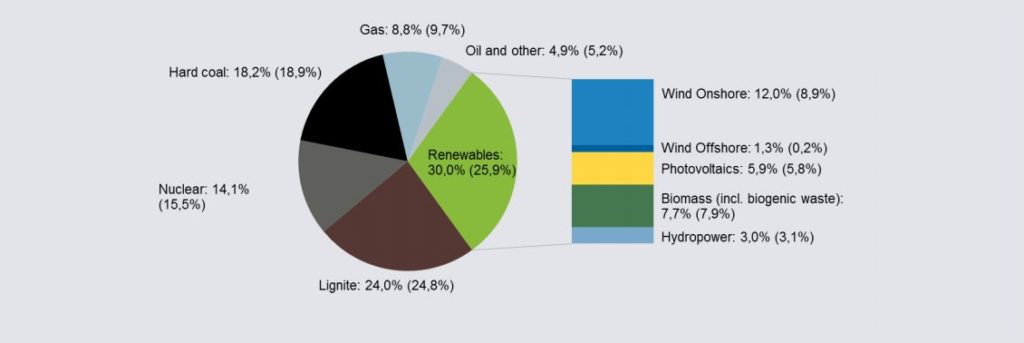

Progress has been very impressive so far. In terms of renewables Germany is ahead of plan. Thus in 2015 renewable energy sources produced over 30 % of the demand of electric power. Onshore wind stood for 12.7 %, offshore wind 1.3 %, solar 5.9 %, biomass 7.7 % and hydro 3.0 %.

Germany. Fuel mix 2015. AG Energiebalanzen. Agora: The Energy Transition In the Power Sector. State of Affairs 2015. 2014 numbers within brackets.

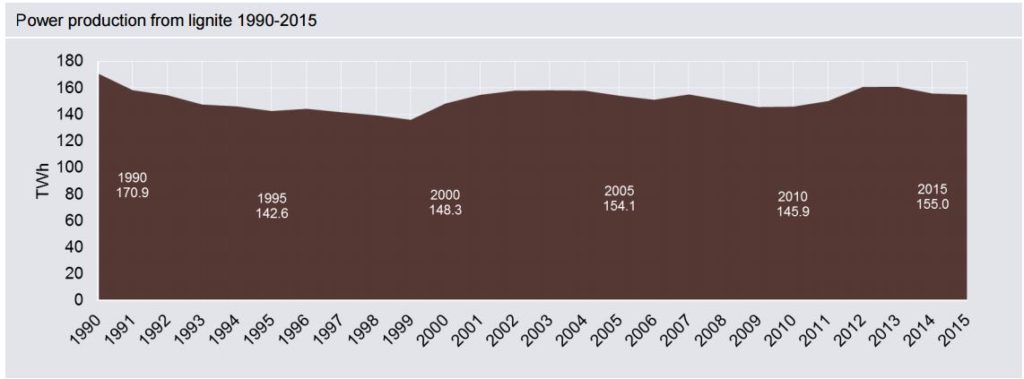

So far balancing the variable wind and solar has been possible by excess thermal power generation and the ability to export the excess. This explains why the decarbonization progress is not equally impressive. Between 2000 and 2010 CO2 was reduced only by 2.8 %, but after 2010 it has been basically unchanged. The reason is that the coal plants, especially the ones using the domestic lignite (brown coal), have not reduced its generation. On the contrary, the power production from lignite has increased with 8 % since 2000. With more wind and solar coming online the excess power has been exported to neighboring countries. In fact the net export of electricity has grown to a record 60.97 TWh in 2015. It is 10 % of all electric power generated in Germany.

Germany. Power production from lignite. AG Energiebalanzen 2015. Agora: The Energy Transition in the Power Sector. State of Affairs 2015.

Ironically the exported low cost lignite power from Germany has made it difficult for cleaner power sources in neighboring countries to compete. They also feel the impact of loop flows of power through their countries of primarily wind power from northern Germany to loads in southern Germany. Agora, the strong and insightful German think tank focused on Energiewende, early pointed out the importance an expanded and robust transmission system to enable the integration of large amounts of wind and solar. So far this expected expansion of the transmission system, especially three new north-south HVDC (High Voltage Direct Current) transmission lines, has not happened.

Most of the future additional renewable energy resources are offshore wind in the North Sea. However, with the present constraints of the transmission system it is not possible to develop in a substantial way. As a result until something changes it will be difficult to move forward with the Energiewende.

Consequently, it did not come as a complete surprise, when Chancellor Angela Merkel on June 1 could announce a new framework with the 16 States to curb the costs and reduce the speed of future expansion of green power sources. In essence the agreement sets 2.8 GW as the upper annual limit for new onshore wind generation, 600 MW as the upper limit for solar power. There will also be upper limits set for biomass power generation projects. Due to the transmission constraints only certain amounts of new capacity will be permitted in northern Germany.

It is not a dead end for the Energiewende, but the foot has moved from the gas pedal to the brakes. To be able to get the foot back on the gas pedal and reach the 2050 goals, several critical choices of what roads to take will need to be made. There are five major forks in the road ahead: Demand response (DR), Transmission, Storage, Plug-In Electric Vehicles (PEV, including all electric and plug-in hybrids)) and Natural Gas.

Germany has been remarkably late in deploying DR. With excessive generation there have been not been much need for it. However, going forward DR could help substantially reduce peak demand and/or provide capacity reserves similar to what e g PJM and California have achieved. In order to do so regulatory barriers will need to be removed and markets valuing flexibility to be developed.

Expansion of the transmission system, especially the north-south corridors, is a must. The first of the north-south HVDC transmission lines has been federally approved but still struggles with States’ permits. One possible outcome may be that the HVDC transmission lines will be underground with cable instead of overhead power lines. Remarkable development of the insulation of DC cables is making the cable alternative increasingly viable.

While progress of transmission development within Germany is slow, Germany continues to expand its connection to the Nordpool system. The latest addition will be the 1400 MW Nordlink between Norway and Germany. This state-of-the-art VSC (Voltage Source Converter) HVDC project is scheduled to be completed in 2019. It will be the longest European interconnector, 623 kilometers (380 miles).

Interconnections between Nordpool zone and continental Europe grid. ABB white paper about Nordlink. March 2015.

Nordlink will substantially expand access to Norway’s large amounts of flexible hydro power. One of the most intriguing discussions is to take it one step further and have Norwegian hydro to become a very large energy storage resource. See more: A Blue Battery Solving A Green Problem

When it comes to battery storage, there is so far very little. It is mostly at residential level. Nevertheless, Sonnen, a German company founded in 2008, with over 10 000 systems installed has become a leader of small (4-16 kWh) battery energy storage systems and expanded its presence to California and Hawaii. Also Mercedes, similar to Tesla, offers batteries for homes. In Mercedes case the building block is a 2.5 kWh module. Up to 8 modules can be aggregated into a 20 kWh system. For utility size battery storage one can assume that Germany is keeping a close eye on California, where the utilities have been mandated to have 1.3 GW of batteries by 2020.

The Energiewende assumes transportation to eventually become more electric. With the challenges at hand with transmission build out and limited amounts of stationary energy solutions attention to the PEVs as a storage resource is increasing. There are 45 million cars in Germany. 1 million PEVs with a 40 kWh battery add up to 40 GWh of battery storage! Evidently it is being discussed in “high places”. A rumor about a new mandate that all new cars to be electric by 2030 turned out to be a quote out of context by the Secretary of Economy and Energy Rainer Baake. He had “only” said that a mandate by 2030 would be necessary if the emissions goals are to be achieved. If such a mandate will happen remains to be seen, but most likely direct and indirect support to the German automakers to provide more PEVs will increase. Already VW, Mercedes and BMW sell PEVs. VW burnt by the “clean diesel” debacle seems to be moving most aggressively in this direction. According to VW’s chairman and CEO Matthias Muller recently stated VW is working on a plan to produce 1 million PEVs annually by 2025. VW is also considering to invest $11 B into a Giga factory for batteries.

Probably the single most important road to take will be to build up a very robust natural gas infrastructure in order to enable starting to phase out coal on top of phasing all nuclear by 2022. Not only are combined cycle gas turbines (CCGT) 50 % more efficient than coal, CCGTs and gas turbines are much more flexible, which is crucial when balancing the variable sources, wind and solar. Phasing out coal will be a tough one not least from a national security perspective. Lignite is the only domestic fuel source of significance. Transitioning from coal to more natural gas will be necessary if the Energiewende goals shall be achieved. However, it will not happen if the national security aspects of fuel supply chain are compromised.

Consequently, a very robust natural gas infrastructure with many alternative routes and sources of gas will be a prerequisite. Interestingly, much more quiet than the expansion of wind and solar but equally determined, is the planning and construction of several strategic gas pipelines. The biggest project is Nord Stream from Vyborg in Russia through the Baltic Sea to Greifswald in Germany. It was completed in 2012 and is the longest sub-sea pipeline in the world. In fact there are two parallel pipelines with a total annual capacity of 55 billion cubic meters. The five shareholders of Nord Stream are Gazprom (51%), BASF/Wintershal (15.5 %), E.ON (15.5 %), Niderlandische Gasuni (9%) and ENGIE (9%). Former Chancellor Gerhard Schröder is the chairman of the board. Even though all that capacity presently is not used, there are already initiatives for a Nord Stream 2, which would double the capacity. Some European countries, for example Italy and Hungary are very critical against the project.

Nordstream pipelines. 1220 kilometers (730 miles). Direct connection of gas from Russia to Germany.

Still more controversial than Nord Stream 2 is the European Gas pipeline Link (EUGAL), which targets to bring natural gas from Greifswald area to southern Saxony and from there to the border of the Czech Republic. EUGAL is a joint venture between Gazprom and BASF/Wintershall. The project, which is in the early planning phase, targets to have an annual capacity of 51 billion cubic meters, I e about the same capacity as Nord Stream. If built, Nord Stream 2 and EUGAL would strengthen Germany’s position on the European gas market as a key gas hub, both as a flexible transport hub and as a gas trading hub.

In conclusion Germany is ahead of plan in terms wind and solar expansion, but the speed of transition has slowed down and the single biggest challenge, phasing out coal remains. With the close industry-government coordination and the strong public support for Energiwende one would expect Germany will be able to resolve most of the present roadblocks.

One thing for sure Germany is firmly in the driver’s seat and they are very determined to keep their pole position in Europe.