Yogi Berra had it right: The future ain’t what it used to be.

Planning in the electric industry is basically about ensuring reliability at reasonable costs. For investors it is about optimizing expected return on investments with risks. It has never been easy, but it is more difficult than ever today.

From the start of electrification in 1890s demand grew exponentially. It made the market risk small. The dominant technologies were hydro power and coal based thermal power. The technology risk was mostly about the scaling of the power plants. In the aftermath of Samuel Insull’s failed attempt to build a mega electric utility the Public Utility Holding Company Act (PUHCA) of 1935 removed most of the financial risks. PUHCA gave investor owned electric utilities monopolies and guaranteed rate of returns in exchange for the obligation to serve. It allowed the utilities to be long-term deploying integrated resource plans with a financial stability, crucial for funding the growth of the industry.

It is worthwhile to notice that some of the historically largest electric power and electric infrastructure developments would probably not been possible without government owned entities. It was also the case when Columbia River hydro power, which now provides over 40 % of U.S. hydroelectric power generation, was developed in the 30s and 40s. All the major dams and power stations along the river, adding up to 22 gigawatt (GW), are owned and operated by the US Army Corps of Engineers and Bureau of Reclamation. Federally owned Bonneville Power Administration (BPA) built and operates most of the transmission infrastructure in the region. In a similar way Hydro Quebec was formed by Government of Quebec in 1944 to develop the hydro power and associated transmission systems, making Hydro Quebec one of the largest electric utilities in the world. They own and operate close to 35 GW of hydro power as well as one of the largest and most advanced transmission system in North America.

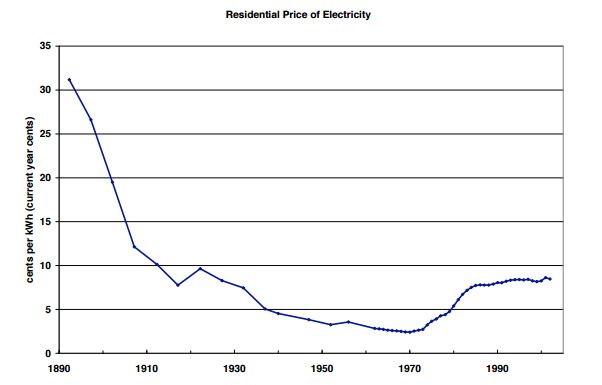

For over half a century this first paradigm worked very well. The economic boom after World War 2, the expanded use of electric appliances and not least the introduction of air conditioning kept electric demand growing at a high pace. Thanks to strong economy of scale, building ever larger power plants, resulted in ever lower electricity costs to the consumers.

Residential price of electricit, in current-year cents per kilowatt-hour. Source: Morgan, et al (2005).

However, things started to significantly change in the 70s and early 80s. The 1973 oil embargo hit hard and the Iranian Revolution triggered the energy crisis of 1979. The growth in demand of electricity started to slow substantially. Before it was fully understood power plants continued to be built for the previously assumed/expected higher demand, resulting in over-capacity. With higher fuel prices on top it created upwards price pressures.

Nuclear energy did not bring the “too low to meter” costs many had hoped for. On the contrary, due to lack of standardization, design changes, safety changes from the Nuclear Regulatory Commission (NRC), inflation and other factors, nuclear power was hit by delays and large cost overruns. The most visible case was probably Washington Public Power Supply System (WPPSS). In expectation of very high load growth they had embarked on plan to build five nuclear power plants. Eventually one of the five plants got built. When WPPSS in 1983 defaulted on $2.25 billion in municipal bonds, which is the second largest municipal bond default in U.S. history, it gave WPPSS the nickname “Whoops” and its customers higher electricity rates.

More things were changing. The economy of scale for thermal power plants started to come to an end. Generators had continued to be scaled up in size, but when the steam turbines started to reach 800 megawatt (MW) and trying to push beyond, it became increasingly technically challenging to maintain high availability and reliability. In addition the need for redundancy in case of a failure became expensive. However, what really changed economies of scale was a new technology, natuural gas fired combined cycle gas turbines (CCGT), which had electric efficiencies around 50 % and could economically be built in the range of 100 – 500 MW.

The CCGTs, which also could be built much faster and at a lower cost than the large thermal power plants, contributed to a paradigm shift to deregulation and markets. PUHCA was “replaced” by the Energy Policy Act of 1992 (EPACT92). The intent was to make power generators to compete by giving open access to the transmission systems, and that way mitigate the upwards price pressures. EPACT92 also amended the Public Utility Regulatory Policies Act (PURPA) of 1978. PURPA was a response to the 1973 energy crisis and a precursor to the open access. It created a market for non-utility power producers or independent power producers (IPP), giving birth to companies like AES, Enron, Calpine and Dynegy.

Deregulation moved risk from consumers to investors. Even though he had not investors in mind, Winston Churchill so accurately said: It is always wise to look ahead, but difficult to look further than you can see. For the same reasons, to mitigate the risks, which also had the addition of regulatory including environmental risks, the investors tended to make the size of the power plants smaller and to look for shorter time horizons. Natural gas fired CCGTs, which have improved further getting up to about 60 % electric efficiency, became the technology of choice, and even more so with the drop in natural gas prices thanks to the shale gas boom.

However, critics of markets point out that very large long-term power projects, such as nuclear and advanced coal (“clean coal”), are more difficult to materialize in markets. The technical, financial and regulatory/environmental risks are huge for these multi-billion dollar projects. Even for the largest corporations with strong balance sheets the risks may be just too big to take. Very large projects like Vogtle 3 and 4 (nuclear), Kemper (integrated gasification combined cycle (IGCC) with carbon capture and sequestration (CCS)) and Edwardsport (IGCC), right or wrong, will happen only in regulated markets and most likely only with various forms of federal and/or state support, such as loan guarantees, grants and tax credits, etc.

Vogtle 3 and 4 expected to go in operation 2017 and 2018. State-of-the-art nuclear technology, Westinghouse Advanced Passive Technology AP1000 with each unit at 1117 MW. First application filed in April 2008. Construction licence recieved in 2012. Expected life 50 – 70 years. Expected cost $16.5 B with a $8.33 B federal loan guarantee.

We have been in this second paradigm for some 30 – 40 years. At the wholesale level markets have by and large worked well, even though wholesale price reductions have not resulted in corresponding price reductions at the retail level. Regional transmission operators (RTOs) and Independent system operators (ISO) have brought economy of scale thanks to regional transmission planning and optimization of power generation over a larger footprint. Markets are efficient in quickly responding to changes in technology and fuel costs. The unprecedented pace of transition from coal fired power plants to natural gas fired CCGTs would probably not have happened as fast in non-markets.

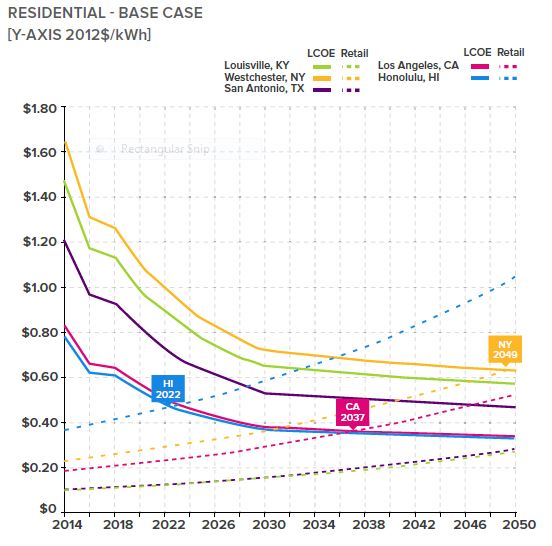

A third paradigm shift is now emerging. Energy efficiency and distributed generation have brought load growth on the utility side of the meter down to 1 % per year or less. The cost of solar photovoltaic (PV) has come down dramatically the last 10 years. Coupled with federal and state support PV has taken off. In 2014 the U.S. installed over 6000 MW of PV and over 750 MW of concentrating solar power to reach 20 GW of total installed solar capacity. Energy storage starts to become viable. Access to low cost natural gas is making distributed generation with combined heat and power (CHP) increasingly attractive. Smart grid concepts incorporate demand response enabling load to respond to price signals. Microgrids are becoming reality. Plug-in electric vehicles will increasingly become part of the electric system. Etc.

Grid parity. Projections when solar photovoltaic (PV) combined with batteries may be cheaper than utility retail prices. From a report, “The Economics of Grid Defection”, by Rocky Mountain Institute (RMI), 2014.

This third paradigm based on a significant amount of distributed resources, generation and storage, will bring major opportunities for reducing costs, while at the same time making the electric system more reliable, more resilient and cleaner. However, it will not come without some very major challenges as well. The biggest challenge will be to find ways to take advantage of the existing electric infrastructure and truly optimize the benefits of economy of scale of centralized power over large footprints with the local benefits of distributed resources and flexible load. In addition to technical challenges there are economic challenges, e g developing markets at the retail level and resolving a whole set of fairness (e g net metering and cross-subsidization) and legacy (“stranded investments”) issues. Not to be underestimated are also the regulatory and environmental challenges.

Nobody can say for sure how the third paradigm will evolve during the next 20 – 30 years or so. The only thing we know is that like in any fundamental transition there will be winners and losers.