Energiewende, The German Energy Transition. In a 1954 the Atomic Energy Commission Chairman Lewis Strauss in a speech predicted that “It is not too much to expect that our children will enjoy in their homes electric energy too cheap to meter.” While later disputed whether the optimism was based on high expectations of fusion energy or on nuclear power in general, the phrase has stuck with critics of over-promises of not only nuclear energy but also of other “new technologies”.

If not “too cheap to meter” in 2004 the German Minister for Environment, Nature Conservation and Nuclear Safety, Jürgen Trittin, came close, when he (in)famously stated that the surcharge (“Umlage”) for the German Energy Transition (“Energiewende”) to renewable energy, primarily wind and solar, for a household would amount to “only around one euro per month, the price of a scoop of ice cream”.

The reality turned out differently. A German household has now (2018) some of the highest prices for electricity in Europe, 33.9 cents/kWh, including the surcharge for the energy transition. As a comparison the average retail electricity price (2018) in Europe is about 24 cents/kWh and in the United States is 13.9 cents/KWh.

The costs for Energiewende are subject for a lot of discussions about assumptions and if-and-how to net the costs with benefits. The basic concept to subsidize renewable is through feed-in-tariffs, which grant investors in renewable energy secure cash inflows. The consumers, with electricity intensive manufacturers largely exempted, pay for the difference of the feed-in-tariffs and the sale of the renewable energy through a surcharge. The surcharge is presently 6.7 cents/kWh. The numbers add up to an annual amount ranging from 15 to 40 billion euros ($16.5 to 44 billion), which is about 0.5% to 1.2% of Germany’s current gross domestic product (GDP). However, as proponents for Energiewende points out, if carbon costs would be added to the equation, the net costs would improve significantly over the alternatives.

The fixed feed-in-tariffs were first set by the Renewable Energy Act in 2000 by the Red – Green government (Social Democrats (SPD) and Grüne) and for a period of 20 years. By many it is seen as the start of Energiewende. The present goals for the Energiwende were set by the Angela Merkel government (a coalition of the Christian Democratic Union (CDU), the Christian Social Union of Bavaria (CSU) and the Free Democratic Party (FDP)) in September 2010 through its energy strategy roadmap, “Energiekonzept”. For renewable energy the goals are to achieve 25-40% renewable energy by 2025, 55-60% by 2035 and 80% by 2050. For greenhouse gases (GHG) the goal is to reduce by 80-95% from 1990 to 2050. A key component in the Energiekonzept is to improve the energy efficiency by 50% from 2008 to 2050.

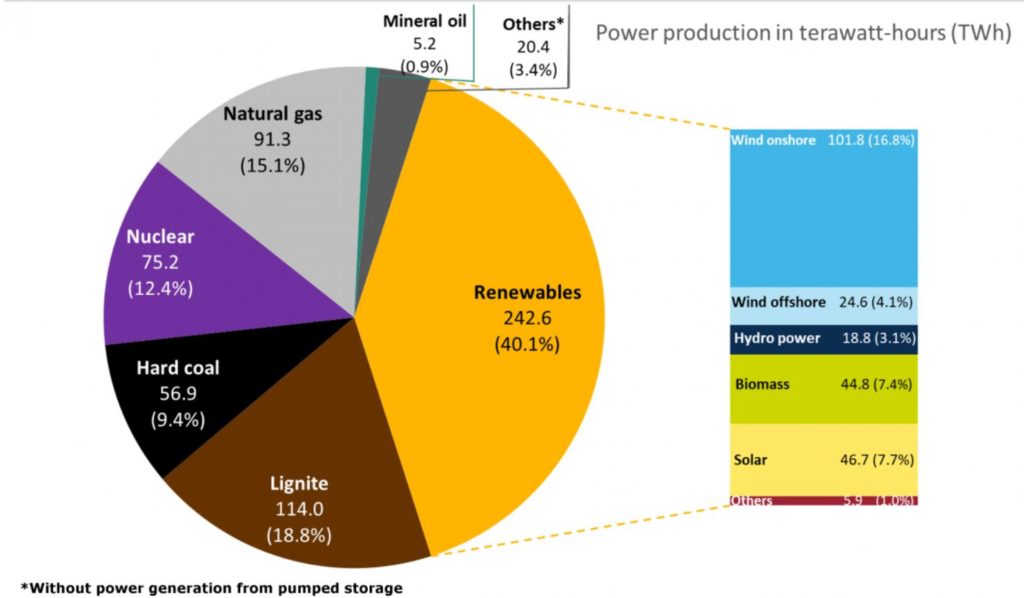

In 2000, just about 5% of the German power production was renewable energy. Nineteen years later, 2019, renewables had grown to 40%! Impressive and ahead of schedule, but next phases will be very challenging. The onshore wind build-out has slowed. In the Climate Action Programme 2030, which was adopted last year (2019) by the Merkel government, the new target for onshore wind has been scaled down from the previous target of 80 gigawatts (GW) to a range of 67 to 71 GW. Offshore wind, which has reached 6.5 GW is targeted to be expanded to 20 GW by 2030. The biggest increase in capacity is for solar. The new target is to reach 98 GW of solar from 49 GW currently.

Data: AG Energiebalanzen 2019, preliminary. Source: Clean Energy Wire.

Despite the massive growth of wind and solar the reduction of GHG has not come down as one would have expected. By 2000 the GHG had been reduced to 84% of the 1990 level, but from 2000 to 2018 it only come down to 69%. The goal remains to be lower than 20% by 2050. The main reason for not have come down further is that Germany has started to phase out the nuclear plants, while at the same time not only kept its coal power plants but even built new plants. The latest, and probably last, coal-fired power plant is scheduled to come on-line later this year (2020) will be the Datteln, a state-of-the-art 1.1 GW power plant. From a GHG reduction perspective it had made more sense to keep the nuclear while phasing out coal. However, from a German fuel security perspective it is understandable. Lignite coal is the only domestic fuel of significance. There is also a strong anti-nuclear movement in Germany dating back to early 1970s. Following the Fukushima nuclear accident 2011 Angela Merkel announced in May same year that Germany’s 17 nuclear power stations will all be shut down by 2022. It was confirmed by an overwhelming majority in both chambers of the German parliament.

Probably the single biggest challenge going forward will be the phase out of coal. There are presently over 80 coal-fired power plants. They stood for 28% of the gross German power production in 2019. The German government (a coalition between CDU/CSU and SPD) adopted last year (August 2019) to end coal-fired generation latest by 2038. It was based on a recommendation by the German coal exit commission. The commission also recommended to assess progress and targets in 2026, 2029 and 2032 to accelerate the phase out by 2035. The government has said it will follow the recommendation. More than government direct actions, economics may accelerate the phase out.

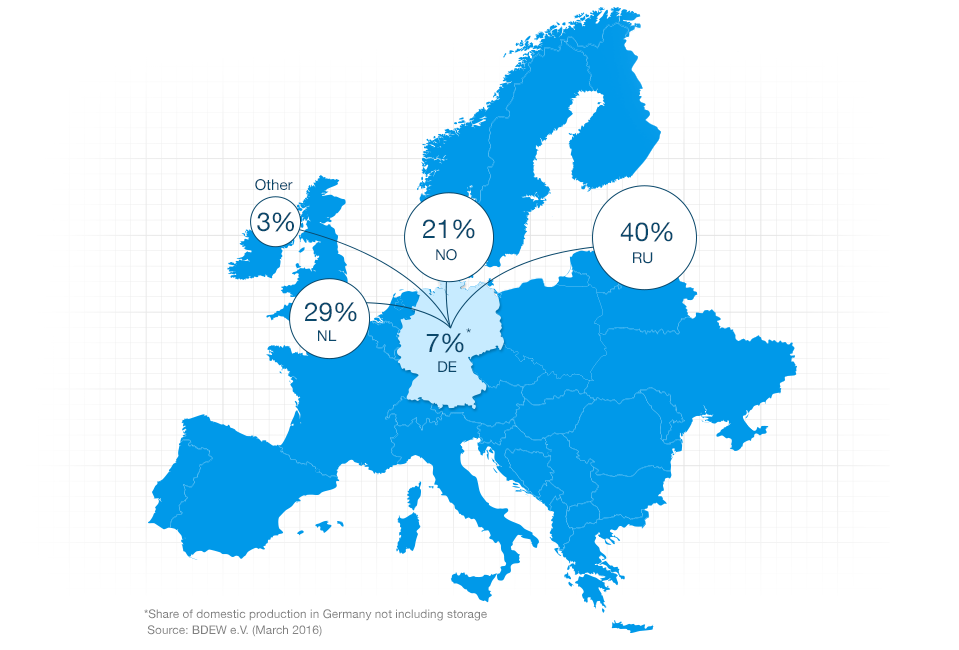

Most likely natural gas combined cycle generation (CCGT) will fill a substantial portion of the void after the nuclear and coal power plants. The Energiewende 2050 target for renewables is 80%. The remaining 20% could very well be natural gas CCGTs, not least thanks to the flexibility they can provide. Recognizing the strategic importance of fuel security Germany has built up the gas infrastructure to make Germany a physical and commercial hub for natural gas in Europe.

With more and more variable resources, wind and solar, on the system, balancing the electric system is critical. Thanks to the feed-in-tariffs wind and solar have become “base-load”. So far, the balancing has been achieved by increasing export and import of power. Running the low-cost coal fired power plants at high capacity increased the power export balance. However, both export and import dropped in 2019, which may have been the result of the higher prices for carbon on the European Emissions Trading Systems. Beginning 2018 prices were about 7.50 euros per ton. Since beginning 2019 the prices have been above 20 euros per ton, making coal fired generation more expensive.

Augmenting the challenge of balancing the system is the limited transmission capacity north-south in Germany. It has resulted in loop flows through neighboring countries, in particular Poland and the Czech Republic. To limit the loops flows phase angle regulating transformers had to be installed. It was early identified that three new HVDC lines would need to be built to move wind power from the north to the load in the south. Only after new federal legislation in December 2015 allowing financial recovery of underground cables, there have been progress towards the first of the three HVDC lines, the Suedlink, which earliest will be energized in 2025. The balancing of the grid is helped by the HVDC ties with Sweden, 0.6 GW built in 1994, and Norway, 1.4 GW to be commissioned later this year (2020), bringing access to hydro power.

Even if the transmission system will be built out, there will be times when the wind and solar will need to be curtailed. The German peak power is about 85 GW. Assuming the targets for 2030 will be met, there will be almost 200 GW of wind and solar capacity. If all that power would be generated at the same time, it is much more than what can be consumed in Germany as well as exported to neighboring countries. Battery storage can help, but unless some break-through technologies, it is not economically viable given the huge amounts and duration of the energy to be stored. This realization has triggered interest in new ways to use the excess power. One of the more interesting concepts is power to gas (ptg), I e using the excess electricity from the renewable generation to produce “green” hydrogen with electrolysers. The hydrogen can be used either directly or used in further processes into carbon neutral liquid fuels. It is expected to be an integral part of a hydrogen strategy under development by the German government. The strategy is anticipated to be presented later this year. Targets like 1.5 GW by 2025 and 7.5 GW by 2030 of ptg has been mentioned. Who knows by 2050 when looking back, Energiewende may have started a transition to the “hydrogen economy”?

The costs for Energiewende going forward will be very high. Just the closing of the nuclear power plants are estimated to cost about €65 billion. Phasing out of the coal may cost almost as much. The Federation of German Industries (BDI) had a study in 2018 by Boston Consulting Group and Prognos AG. They concluded that cutting GHG emissions by 80% by 2050 would require cumulative total investment of €1.5 trillion. 80% is the lower end of the 2050 target. Achieving the upper end of the 2050 target, 95%, would require a total investment of about €2.3 trillion.

Energiewende would not been possible without strong and broad public support. The political core is the Green party, Grüne, founded in 1980, and represented in the German Parliament since 1983. They were governing party together with SPD 1998-2002 and 2002-2005. Presently in opposition Grüne got 8% of the votes in the 2017 election. However, in recent polls (January 2020) Grüne has become the second largest political party at about 20%. The largest party is still CDU/CSU polling at about 27%. If the numbers stay to the next election, which will be in October 2021, it may result in a CDU/CSU – Grüne coalition.

While the public support for Energiewende in general is very high, there are concerns about the costs and cases of local opposition against onshore wind farms and approval of new transmission lines. “Not-in my-backyard” (NIMBY) seems alive and well. As a result, new windfarms are required to have a 1-kilometer buffer zone, which restricts new development near populated areas. For new transmission the approval process is very slow, even when it will be built underground. These NIMBY oppositions may ultimately be bigger challenges for Energiewende than the direct costs.

The Energiewende is unique in size and in relative speed. Germany, which is the fourth largest economy in the world, is making a huge investment in a radical effort to transition to a sustainable (“green”) energy system. Some call it a huge experiment. For other countries and states developing their energy policies there are many lessons to be learnt, both good as well as not so good ones. Jürgen Trittin was totally off in his cost predictions, but a bigger mistake may be to ignore the lessons learnt.

Footnote: The word “Energiewende” originates from a book published 1980 by Florentin Krause, Hartmut Bossel and Karl-Friedrich Müller-Reissman. The complete title is “Energiewende; Wachstum und Wohlstand ohne Erdöl and Uran.”

Ironically, considering that the fixed feed-in tariffs started in 2000, it was not until 2011 “Energiewende” became commonly known, largely thanks to Angela Merkel and her Christian Democrats (CDU) party, recognizing the political value by adopting and promoting it.

More information: There are many high-quality sources of information about the Energiewende, for example:

More read: